Taxes in Taiwan

Updated May 15th, 2018

Taxes revolve around just a few issues for people teaching English in Taiwan and for other white-collar workers. Let's take a look at them.

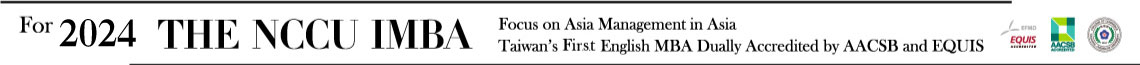

Before we begin, a few things: the tax year in Taiwan runs from January 1st to December 31st. Taxes for the current year are filed in May of the next year. Tax rates depend on your net income for the year: earn up to 540,000, your tax rate is 5%, 540,001 to 1,210,000 it's 12%, 1,210,001 to 2,420,000 it's 20%; 2,420,001 to 4,530,000 it's 30%; 4,530,001 +...40%. The most common for teachers is 12%. If you're single and unmarried the first NT$76,000 earned is untaxed.

Alright. Now, then -- on to the main issues. Arising from Chapter 1, Article 7 of the Income Tax Act there are two governing factors that affect foreign teachers & white-collar professionals working in Taiwan. The first: you need to be in Taiwan more than 183 days during any one calendar year to be taxed at the standard rates for your income level. (The cutoff date for 183 days is normally July 2nd.) If you are in Taiwan less than 183 days in any calendar year you will pay 18% tax no matter what your income level is.

The second: when your job overlaps into a new year your employer will use the time remaining on your ARC time to determine what tax rate you should pay. If your contract overlaps into another calendar year and, according to the date of your ARC, the number of days remaining to work is fewer than 183, your job will tax your earnings at 18%.

These factors lead to three specific situations for most foreign teachers & other white-collar professionals in Taiwan.

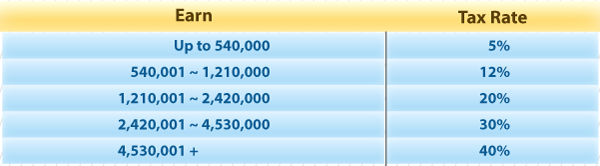

1. Arrive in Taiwan After the 183 Day Cutoff

You arrive in Taiwan AFTER July 2nd and sign a one-year contract. There are less than 183 days left in the calendar year you’ve arrived in. You will be taxed at 18% for all the remaining months of the current year. When the new year starts the time remaining on your contract has you in Taiwan for MORE than 183 days. So, you'll see your rates reduced to the normal level for the remaining months on your contract.

An example: you arrive in Taiwan on November 1st and sign a one-year contract. For November & December you would be taxed at 18%, since for that year you're here for less than 183 days. For January through October of the NEXT year you would be in Taiwan for more than 183 and would see your tax rate reduced to the standard level. Even though on January 1st you’ve been in Taiwan for just 1 day of the new calendar year your school goes by the more than 183 days remaining on your contract in that year, and lowers you to the standard rate.

2. Arrive in Taiwan Before the 183 Day Cutoff, But Not on January 1st

You arrive in Taiwan BEFORE July 2nd --- but after January 1st --- and sign a 1-year contract. This contract will have you in Taiwan for more than 183 days for the calendar year you’ve arrived in. You would be taxed at standard rates. However, your one-year contract trails into the NEXT calendar year, since you signed after January 1st. As that new year starts your remaining contracted time is less than 183 days. Your tax rate for that time will return to 18%. If you do stay on in Taiwan more than 183 days during that next year any overage you paid would be refunded to you when you filed your taxes for that year.

An example: you arrive in Taiwan & start a job on March 1st. March through December is 10 months, clearly more than 183 days. So, you’ll be taxed at standard rates for that time. BUT – you signed a one-year contract in March. So, you still have January & February to work in the NEXT year. For those two months you’ll pay 18%. If you sign a new one-year contract on March 1st the that contract states that you’ll be in Taiwan for more than 183 days, so from March 1st, you’ll start paying standard rates from the start of the new contract. However – in January & February of the following year, you’ll again be taxed at 18%, difference refunded if you stay more than 183 days when you file for that year.

3. Arrive in Taiwan & Start Work on January 1st

You arrive in Taiwan & start on January 1st. Your contract will have you in the country for more than 183 days for the calendar year. For the full year you will pay standard rates. If you sign again on January 1st you would again pay the standard rates for the full year.

Interpretation

The obvious impact of all this is that the very BEST time to arrive & start a job in Taiwan is on January 1st. This may have been what the tax folks were driving at when they revised the regulations.

However, if that’s not the way it happened or will happen for you, then the choice of arriving AFTER July in Taiwan 2nd seems to provide the least hassle. While you would pay the high rate for the 1st few months, as long as you signed successive one-year contracts each starting before July 2nd you would not again face the 18%.

For example, arriving in Taiwan and signing a contract on October 1st would see you paying 18% for those last three months of your 1st year. For the January ~ September of your next year, well that’s more than 183 days, so regular rates. September ends, you sign a new contract October 1st. Well, by October 1st you’ve already been in Taiwan those 9 months. So with your new contract October, November & December are also at regular rates. The new year comes along in January, your contract has you in Taiwan for 9 more months. You continue at regular rates.

Arriving in Taiwan and starting your job after January 1st but BEFORE July 2nd is a much different scenario. You’ll face an (in-Taiwan) lifetime of changing tax rates.

Here’s an example. You arrive in Taiwan and sign a contract on May 1st. May through December is 8 months, more than 183 days. So, for those 8 months you’ll pay regular rates. Yet, in the new year, you have just 4 months remaining on your contract. Your job uses the total months remaining on your ARC to decide what your tax rate should be. With only 4 months remaining, January ~ April, you’ll go back to 18%. If you choose to sign a new one-year contract in May you would be returned to regular rates for May ~ December BUT… along comes your next year, and you are back in the same boat – just 4 months remaining in a 1 year contract at the start of a year, so back to 18%.

If you sign a new contract and stay on in Taiwan after those 4 months you can, when you file your taxes, get the difference between the 18% rate and your regular tax rate refunded. Nonetheless, arriving and starting your job after January 1st but before July 2nd you would continue to see a cycle of regular rates followed by 18% rates repeated over and over.

FAQ

Q: What if I go into a new calendar year with contracted time of more than 183 days but go home before I reach 183 days?

A: Sometimes, you can sign a contract that has you working in a new calendar year more than 183 days, but you leave Taiwan before you reach that point. For example, if you signed a 1-year contract in November. That’s 2 months in one calendar year and 10 months in the next. You would be taxed at 18% for November & December. When January came along your school would start taking the standard rates, since in that new year you were contracted for 10 months of work – more than 183 days.

But, let’s say you quit your job at the end of March and left Taiwan. Your school had started taking the standard rate for your income level when you crossed into the new calendar year. But, you left after having been in Taiwan for just 3 months of that new calendar year. When your school sends your last paycheck they would deduct the difference between the regular tax rate for ALL the months of the new year. If you had been taxed at 10% for January & February they would re-calculate those at the 18% tax rate months, figure the difference and take that out of your March pay, as well as increasing the tax rate on your March salary to 18%.

Q: I have just gotten a job and an ARC, but I've been in Taiwan four months already! Do those first months count toward my 183 days?

A: Yes. The 183 day total is calculated by the total time you've been in Taiwan, not by what you were doing. It goes by the dates in your passport, exclusive of the first day. If you came to Taiwan on January 1st, but didn't get an ARC until May 2nd, you would have to pay 18% tax for just two months. The 183 days are figured by your arrival date: you arrived 4 months ago, so, even though you are just getting your ARC and beginning to work, those first 4 months are included toward your 183 days.

Q: I finally made 183 days, but my school only lowered my tax rate to 10%! What's up?!

The accountants tell the schools that, because your hours can vary, it's impossible to predict exactly how much you will earn in a year. Maybe it will be less than 410,000 (no way)? Maybe 1,100,000? Maybe more than 1,500,000? After 183 days, should your school start taking 6%, 13%...21%? The accountants tell them to hedge, hit it in the middle: 10%. You settle the difference when you file in May of next year.

Refund Checks

The tax year in Taiwan runs from January to December. Your taxes for this year are filed during May of the next year. Refunds become available by late November.

Q: I got to Taiwan in January, I'm leaving in December... how can I get my money if taxes are filed in May of NEXT year?

A: You need to find a friend who is a citizen of Taiwan. Ask your job's accounting office to prepare your Earnings Statement (see below for request). Go to your local tax office. Bring your passport, your ARC and the earnings statement from your job. When you go to the tax office in Taiwan they will ask you to fill out a form and can calculate your refund on the spot based upon the Earnings Statement you've given them. Then, they will process it and send you a check. If you're in Taipei, the check will be available within one week. If you're in another part of Taiwan it takes longer. The TAiwan tax folks will send the check to your friend. Additionally, your friend's name will be attached to filing. Should you owe any other taxes, your friend would be responsible .